IRA Contributions The 2024 maximum IRA contribution is $7,000 (from $6,500) for those under the age of 50 and $8000 (from $7,500) for those

Tax Tips

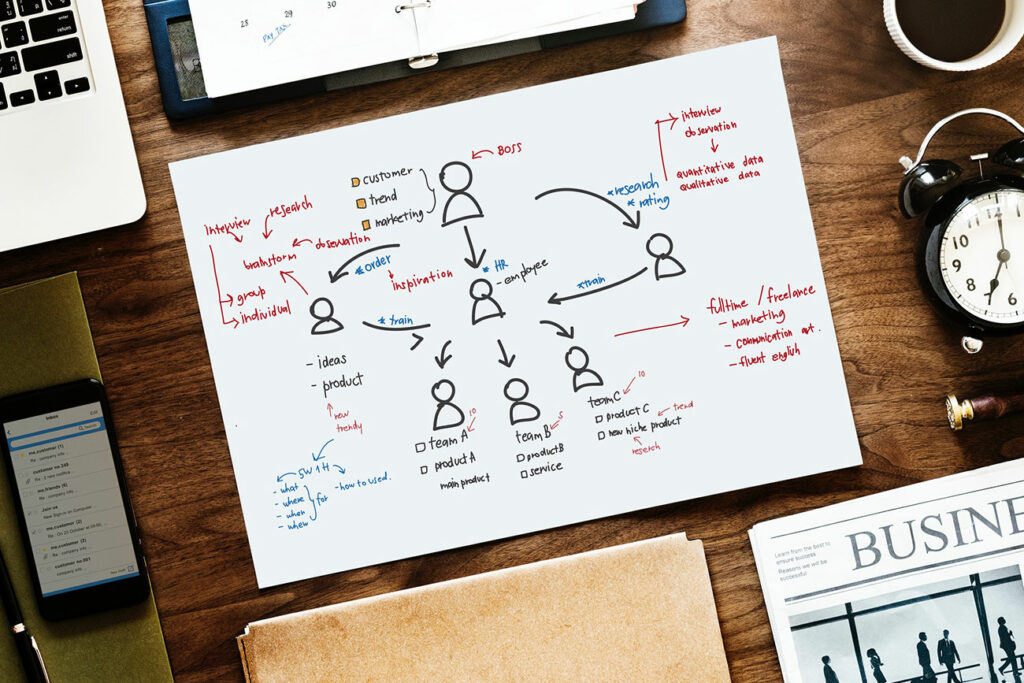

The best tips to prepare for tax-filing season. As the end of the year approaches, it’s a good idea to start thinking about how you’ll handle your federal tax return and business needs.